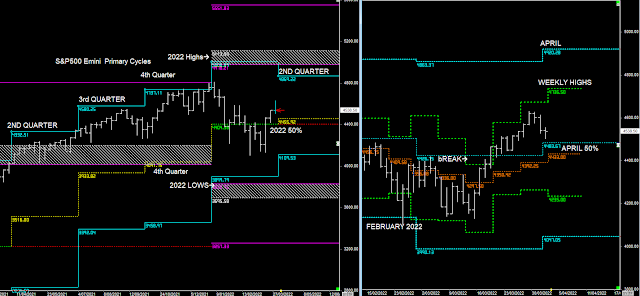

S&P Secondary & Primary Cycles

A month is a long time since my last report, but if you were following me on twitter you would have seen that I mentioned that they would buy the market up into option expiry.

What was looking bearish 1 month ago, has completely changed and I would expect higher prices into December.

However, ideally a move down into the December level of 3924, test support, and then buy it up into the close of 2022.